Hard Truths and Predictions for 2024

How venture will change and where we'll be focusing our time building/investing

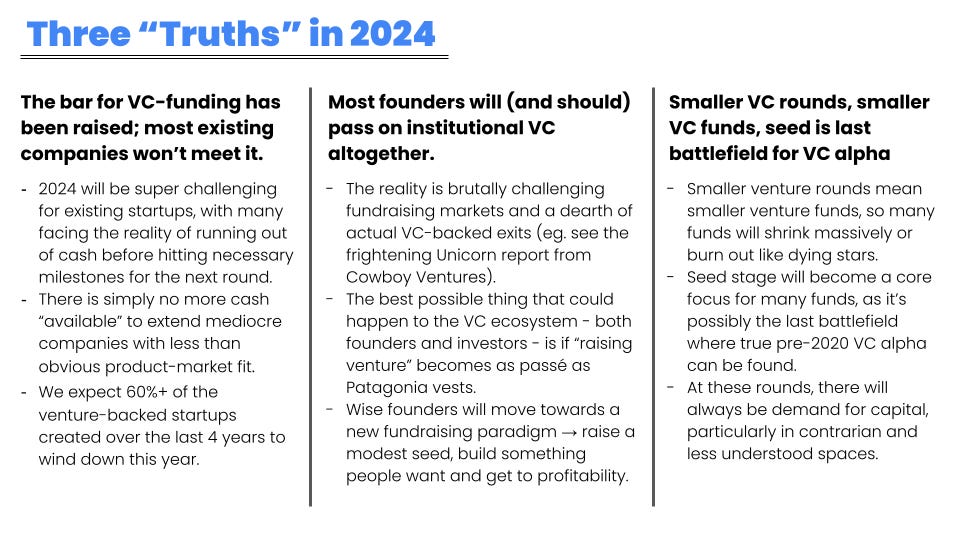

We just sent off our Annual Letter to Night Ventures LPs and wanted to share a snippet of 10 predictions for the consumer sector and broader tech market in 2024. We could be wrong about many/most of these and reserve the right to wipe egg off our face at the end of the year. Outside of these 10 predictions, here are three things that we know to be true…

Enjoy our hot takes for 2024…

#1 → AI still isn’t useful or interesting to “mainstream” America. 2024 will be the year that changes, and it’s likely that incumbents capture 90%+ of the value.

The last two years have gotten a lot of tech industry hype and attention for AI, but in reality, most Americans aren’t using these products yet.

Only 18% of US adults have tried ChatGPT. Why? Because without education, most people still don’t get what it is or why it’s better than Google. Mainstream AI adoption will be dominated by incumbents who already have distribution rails in place (think Canva, Adobe, Amazon).

Think back to the last major “platform shift” – desktop to mobile, 2008 to 2020. While many massive VC homerun companies were built that have changed our daily lives (Uber, Instacart, Snapchat), most of the enterprise value creation (think: market cap) was captured by incumbents, 12 times more than the amount of new companies created.

While we’re bullish on new AI companies and are spending a great deal of time tracking them, we also believe that incumbents will capture 25-30x more market value than new companies in this AI wave.

#2 → Copilots are the most near-term multibillion-dollar AI concept because they get us one step closer to working and living like “superhumans.”

Consumers are eager to adopt AI tools that help them do the work they hate. GitHub Copilot is already writing 46% of code and makes developers 55% faster.

Most AI to date has been in the form of generalized chatbots – we largely believe this whole chat UI format is dumb and a fad.

The real value will be built by well-designed, highly-verticalized copilots (new companies include Harvey for legal, RunwayML for creative). GitHub released the first AI copilot to pass the $100M ARR mark, and multiple consumer and SMB SaaS unicorns will be born in a similar way.

We’re spending a lot of time exploring how copilots could supercharge workflows in areas like legal, education, healthcare, SMB, and much more.

#3 → AI companions are not that far off.

We’re in a loneliness epidemic and we rely so heavily on virtual experiences to keep up old relationships and form new ones. We’re sadder, lonelier and worse off mentally than we’ve ever been before. The status quo is clearly broken.

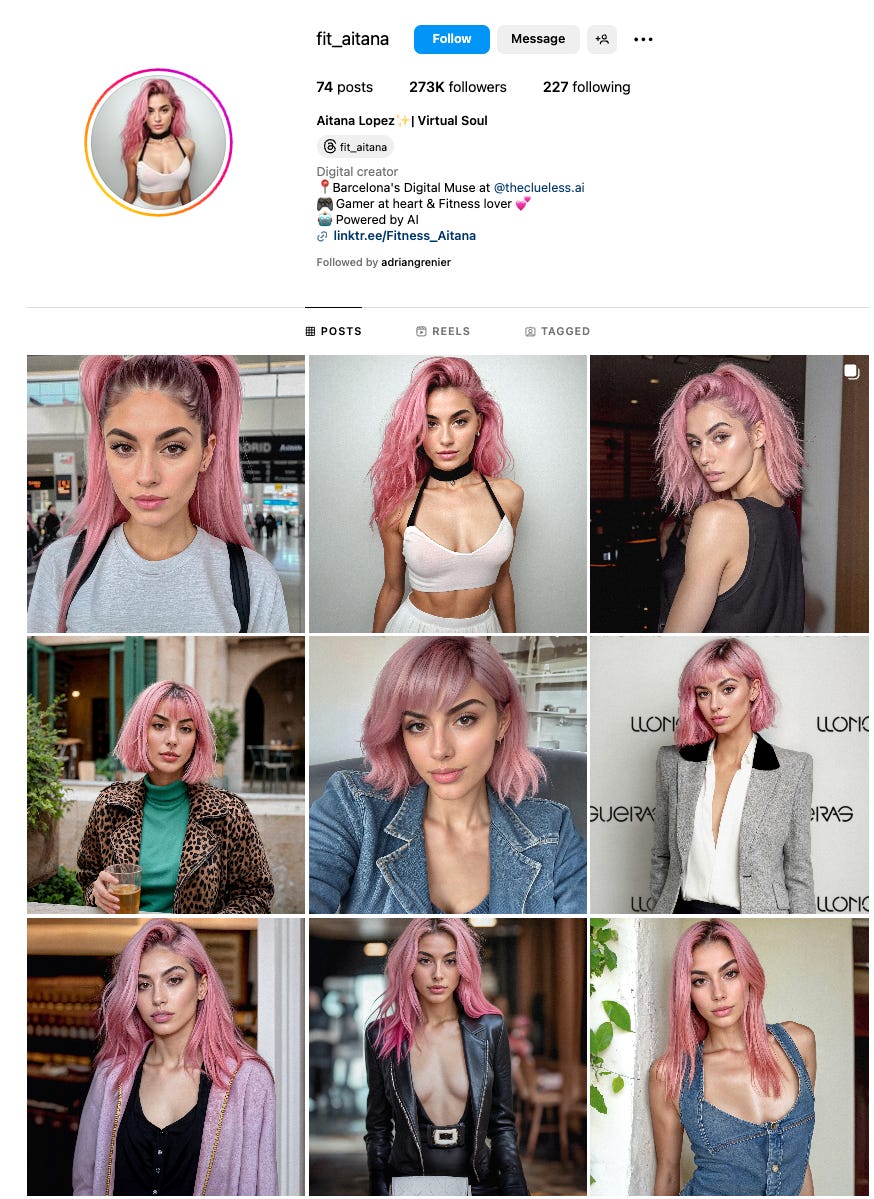

In a world with emotive chatbots, synthetic voices, and hyper realistic image generation, a personalized AI to provide companionship (whether platonic or romantic) seems less of an “if'' and more of a “when.” We think “when” is 2024 – OnlyFans beware.

#4 → AI will have its Napster moment in 2024. Training data guidelines will have to be established and AI-generated content will need policing.

Recently, behemoth model makers like OpenAI and Google have been asked to pay millions annually to license out training data from sources like Reddit and The New York Times. This is only the beginning – in 2024, we’ll see massive legal battles and landmark legal decisions about what can be used to inform a model.

On the other side of the coin, the content that these models spit out will have to be policed. Soon, the power to create hyper realistic images and videos will be in the hands of the masses. Fraud, harmful deepfakes, and misrepresentation will be on the rise right as we enter the biggest election year ever.

That’s why we are thrilled about one of our newest investments, Outtake. Outtake is a legal-tech company that automates deepfake detection and take-down for public figures, celebrities and brands.

#5 → VR/AR will prove to be a rich-people toy that no one needs, and Apple Vision Pro will be a bust.

Remember the Metaverse? Tim Cook is trying to bring it back after Zuckerberg made it pretty clear that no one wants to spend a ton of time in a self-isolating alternate reality. The ski goggles are heavy, bad gaming consoles, and far out of the price range of mainstream America.

Big tech incumbents seem to be losing their view ahead, signaling that the next massive consumer hardware shift could come from somewhere else.

Source: @thijsniks on Twitter

#6 → This won’t be the breakthrough year of the “killer crypto app”, we’re a long way off and probably moving in the wrong direction.

A lot will happen in 2024 in the crypto universe - acceptance and roll out of BTC ETFs in the US, Bitcoin’s 4th halving in April, and the launch of several AAA game studio’s first major blockchain titles. Nonetheless, we still think we are miles away from a legitimate consumer use case (not including speculation, greed or gambling) that will drive mass adoption of this technology.

Here’s our cynical take on what will happen in the 2024 crypto market: Wall Street’s recent change of heart to lobby for mainstream adoption of BTC ETFs will drive tons more capital into space. More capital means another bull run. Higher prices mean more gamblers/speculators and more bullshit artists distracting from useful real-world applications outside of making highly sophisticated traders more money. These “degen gamblers”, as Ethereum founder Vitalik Buterin calls them, stall progress and tarnish the culture of development needed for the space to move forward and be mass-market useful.

#7 → 50M+ Americans will be prescribed GLP-1s (Ozempic, Wegovy, etc).

Patients who start on these weight loss “miracle” drugs have to stay on them forever because they’ll gain the weight back if they stop. 2/3rds of patients don’t make it past a year of GLP1s because the treatment has horrible side effects — daily injections cause severe GI issues and many become clinically malnourished.

We’re looking to invest in improvements to the mechanisms of delivery and other products that support the impact these peptides are having on Americans and their addictions over the next decade.

#8 → GenZ will continue cementing themselves as emotional consumers that spend beyond their means.

The generation (aged 11-26) grew up on social media, constantly bombarded with the perfect lifestyle and every purchase it requires. They expect a gamified shopping experience with instant gratification—trained by BNPL, same-day Amazon, 24/7 GoPuff, and all kinds of rewards. They also started adulthood with more debt and more depression than any generation before them.

This environment bred a consumer cohort driven by FOMO, low self-esteem, and a prevalent “treat yourself” mentality (59% would spend to treat themselves on a bad day).

And as GenZ begins establishing itself in the workplace, impulsive spending behavior is conflicting with long-term financial planning. An alarming 28% have dipped into retirement savings to take an early withdrawal, the highest of any generation.

It’s clear that GenZ’s version of the American Dream will be very different. Consumer spending, homeownership, and family planning will all be impacted by a far more bleak financial foundation. It’s more likely we’ll need to save GenZ from financial ruin before they can save us from climate change, political polarization, etc.

#9 → YouTube will have another massive year as the dominant US social platform for younger consumers.

American teens watch Youtube everyday — it’s the strongest GenZ distribution rail by far. Highly relevant YT personalities are converting fans into highly engaged customers.

In 2024, platforms like Instagram and TikTok will be distracted by social shopping features and give YouTube a bigger lead in it’s already dominant position as the most influential platform for Gen Z and Gen Alpha Americans.

#10 → Consumers will win the battle against live shopping on TikTok and Instagram, but in the years ahead, these platforms will win the war.

Live shopping accounted for about 20% of Chinese retail ecomm sales last year with nearly every major platform participating (see Alibaba’s Tmall and Taobao, Pinduoduo, WeChat, Douyin). This trend has struggled to catch on in the US because there isn’t one dominant “super app” like WeChat that can combine social, streaming, chat, and commerce in a way that feels natural. TikTok Shop is too promotional for American consumers that are excellent at calling bullshit on anything inauthentic and overly “sales-y”.

That said, these companies are dumping billions of dollars into these eCommerce social platforms. While 2024 may not be “the year” it tips in the West, we think it will begin to condition a younger American generation on what it looks like to “shop online.”

Social shopping will make up 20% of American retail eCommerce sales one day, it just won’t be until 2030+.